- Separate your personal and business finances

Separating business and personal finances is essential for accurate tax preparation and financial tracking. Combining these funds often leads to confusion and poor management. Setting up a separate business bank account will help you establish clear boundaries.

- Create a realistic budget

A budget that is realistic will help you manage your finances more effectively. Begin by understanding your business’s revenue and expenses. Keep accurate records of these figures to get a good idea of your business’s financial standing.

Divide your expenditures into categories such as:

- Operational costs

- Employee wages

- Marketing

- Other Fixed Costs

Compare your expenses with your business income and you will be able to determine your profit or loss.

A budget isn’t fixed. It should evolve as your business grows. Regularly update and check your budget in order to reflect any changes to income or expenses. It may be necessary to increase the budget for areas that are growing or reduce it in less profitable areas.

- Understanding your cash flow

Understanding your cash flow, the inflows and outflows of money into and from your business is essential. Knowing how much you make versus how much you spend is key. Cash flow is a good indicator that your company can pay its bills and invest. Monitor your financial activity to maintain a positive flow of cash. For Tewkesbury Accountants, contact Randall & Payne, a leading firm of Tewkesbury Accountants.

It is important to track your income and expenditures regularly in order to be aware of your financial situation. Staying informed will help you make the right decisions when it comes to allocating money. This will ensure that your business is in good financial shape and is ready to capitalize on growth opportunities.

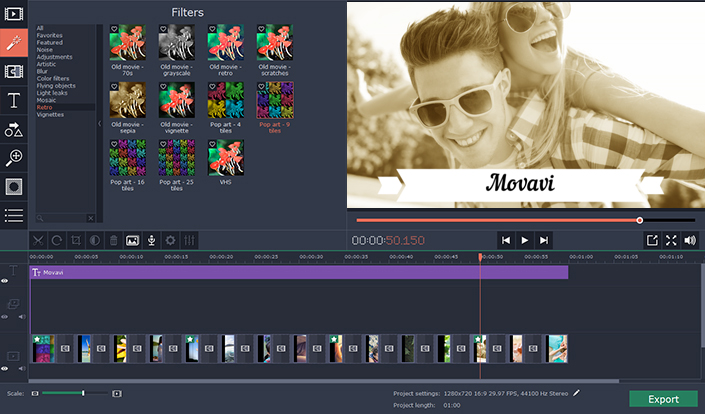

- Select the best accounting software

Accounting software has many advantages. This software can reduce your time spent on financial and bookkeeping tasks. Features such as automated data entry and rapid report generation let you focus on your primary business activities while reducing the time spent on paperwork. It also reduces the chances of human error that is common with manual calculations and record keeping.

- Regularly review your finances

For long-term business success, it is important to regularly review your financial health. It is important to examine financial metrics such as cash flow, margins of profit, expenses and revenue growth. By staying informed about these factors, you can make better decisions and understand the state of your business.

+ There are no comments

Add yours